What is Section 179?

Section 179 of the IRS tax code is a tax deduction that allows companies to write off the full purchase price of equipment or software in the tax year that it was purchased. This accelerates depreciation to a single year instead of writing it off a little at a time.

For example, let’s say a company would like to buy two collaborative robots for $75,000 that were depreciable over five years. They would typically only be able to write off $15,000 a year for five years, which without the tax deduction, might make justifying the purchase a little difficult. But, with Section 179, that same company would be able to deduct the entire $75,000 in equipment from their gross income. As a result, this would enable them to remain competitive and profitable by buying the equipment they need while not taking away from overall tax revenue.

How To Qualify

Although there is a cap of $1,050,000 for the deduction limit and a spending cap of $2,620,000, both new and used equipment qualify for the Section 179 tax deduction (as long as the used equipment is “new to the business”). This is an exciting update from previous years where businesses could only deduct 50% of the equipment value in the first year.

This means that you could potentially buy and write off more equipment as long as your purchases meet the following eligibility requirements:

The purchase must be considered “qualified property.” This means that it must be tangible, depreciable, and used at least 50 percent of the time in the active conduct of business. This includes most material goods used by manufacturers, including “off-the-shelf” software, office equipment, machines, and business vehicles.

The equipment must be put into service by December 31 of the purchase year.

It cannot be obtained from a related party, including siblings, spouses, parents, grandparents, businesses, trusts, and charitable organizations with which you have an established relationship.

How To Claim

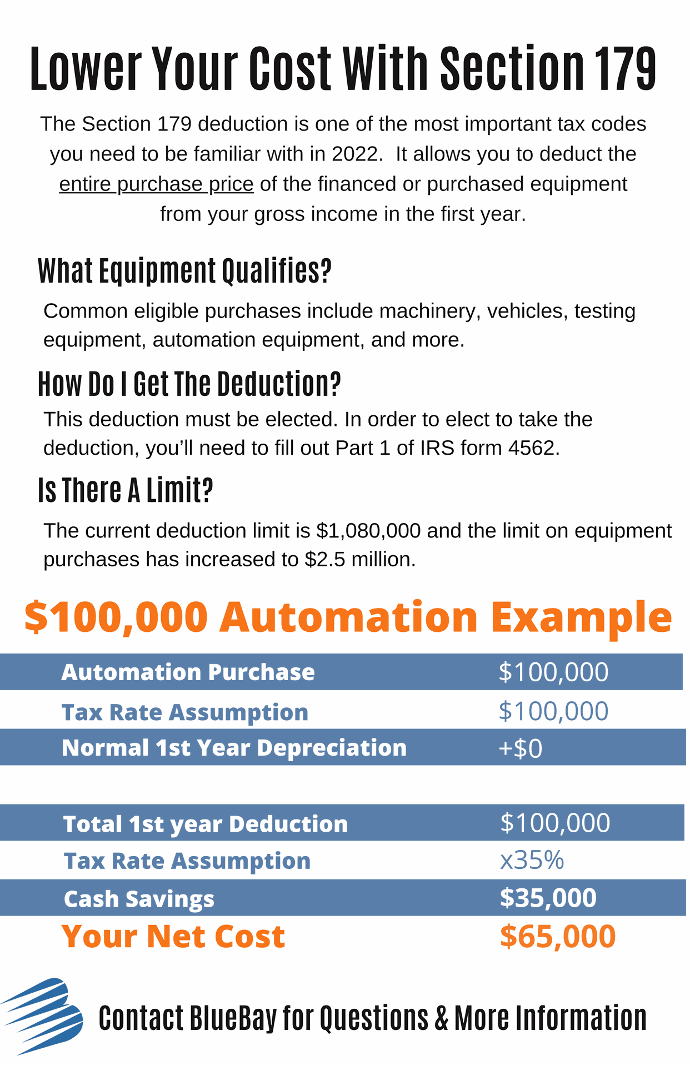

The Section 179 deduction is easy to claim on taxes. All you have to do is fill out Part 1 of Form 4562 and attach it to your tax return. This form must include a description, the cost, and the amount claimed from the qualifying purchase. To get a better idea of your savings, you can use this Section 179 Calculator tool below:

Section 179 - Get Your Tax Break